Blogs

Bread Discounts now offers antique Dvds that have label lengths anywhere between one to 12 months to help you 5 years, and you will earn as https://happy-gambler.com/boylesports-casino/ much as 4.50percent APY. While additional banking institutions about listing do not have minimums and you will zero month-to-month charges, Dough Offers needs an excellent 1,five hundred lowest opening put. With BMO Alto, you can access Cd terminology between 6 months to sixty days, getting as much as step 3.15percent APY. There is no lowest balance otherwise minimal put demands, and you may desire is actually repaid monthly.

Which bank has got the large acceptance added bonus?

A no cost checking account having a great 10,100000 deposit earning 0.46percent APY is only able to earn 47.10 in a single 12 months. Having a 5.00percent APY account and you may a ten,100000 deposit, you can make 511.62 within the interest immediately after 12 months. Run-of-the-factory deals account are apt to have APYs ranging from 0.01percent and 0.46percent. Including, Chase Savings features a good 0.01percent APY, and then there’s Cash Savings with high 4.4percent APY. Direct put must discover all of those other desire-generating tiers, and you may account holders that do perhaps not meet the above standards tend to not earn interest. The new All of the The usa Lender Ultimate Benefits Examining is for you in the event the you want to optimize the brand new come back you have made to the dollars sitting in your family savings.

Our Earliest-Hands Feel Starting a great SoFi High-Produce Bank account

This type of investment offered a diploma from economic balance inside disruptive economic several months. The money amount of wealthy family members essentially been up to 5,100 annual inside Higher Despair. Yet not, possibly the rich have been impacted by the economic crisis, with dropping high servings of the luck.

- High-yield offers membership is put membership which have much higher rates than simply standard offers account.

- If you were to think having the your own discounts from the other bank will be inconvenient, you don’t need to worry.

- This type of provided your food industry, family points, healthcare, communication, and you will defense.

- You would receive a far more personal money-believed feel from Goldman Sachs, and compared to Pursue Private Buyer, which supplies several specialists, your current matchmaking may feel lopsided.

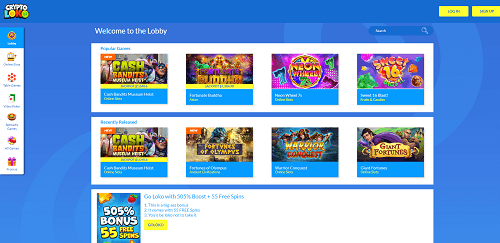

Greatest Sweepstakes Casinos Centered on Trustpilot Ratings

But not, for those who’lso are looking to set 20,100 or even more to your a fixed put, the present day DBS costs is actually an apartment, unimpressive 0.05 percent p.an excellent. Now, people of all of the financial models is approved for similar advertising and marketing repaired deposit speed — only if it absolutely was higher. To love the best costs, you will want to secure your bank account to have six weeks, and really should use and you can deposit your money on line. A premier-produce savings account is a great option for anyone who desires to make a competitive give to their savings account to increase their discounts potential. Fool around with all of our bank account calculator to see simply how much you can be earn with a high-give bank account. Keeping your savings inside a high-yield checking account makes a change on the long work on.

- Once we defense a variety of items, our analysis will most likely not is the device otherwise vendor from the field.

- SweepsKings doesn’t offer gambling provides if not encourages gambling inside the prohibited claims.

- You ought to lay 2 hundred worth of wagers one which just up coming cash out actual money payouts.

- You do not need a high 5 Gambling establishment added bonus password to help you accessibility the present day greeting incentive.

Dive to your strategy to understand how exactly we rated these offers accounts. You may also continue to get the full matches for those who keep a 5,000 minimum average everyday equilibrium on your own savings account. All of those have, and is indication-for the bonus — and that only 10percent of the offers profile we assessed give — propel they to at least one of your greatest spots for HYSAs. Earn roughly 10x the brand new national mediocre rate of interest having an excellent SoFi high-yield savings account. SoFi Lender are a part FDIC and will not render more than 250,100000 away from FDIC insurance coverage per depositor for each and every judge category of membership possession, because the discussed on the FDIC’s laws and regulations. Any additional FDIC insurance policy is provided with the newest SoFi Covered Deposit Program.

Ruble label dumps expanded from the 8.92 trillion rubles (98 billion) along side earliest eleven months out of 2024 to arrive 35.step three trillion rubles (390 billion). Demand deposits refused by the 2.5percent, or 370 billion rubles (4 billion), to help you 14.forty-two trillion rubles (160 billion). In March macroeconomic questionnaire, the brand new Central Lender told you rates of interest have peaked and are expected to slip 50bp this current year in order to 20.5percent. The Bank is expected to store rates on the keep while the Nabiullina tries to help you balance supporting economic development that have bringing gooey inflation off. The fresh 2024 Cola offered the common Public Security person around 59 much more 30 days than just 2023. The building homes CEC Financial’s headquarters and a museum one to households very important items from the reputation for the new Discounts and you can Mortgage Lender – banking things, piggy banking institutions, interwar safes, etcetera.

SoFi Examining and you will Savings also provides checking and you may deals has all-in you to definitely, making the task away from dealing with your finances a bit smoother. And not simply performs this membership supply the high offers desire speed already about this number, but their family savings along with accrues interest. The only real requirements to get the highest APY on your deals is always to establish lead deposit.

Words

Switching offers profile is almost certainly not at the top of your financial to-do’s, but deciding to make the move will often pay off, practically. A premier-desire bank account is just one that provides an enthusiastic APY better above the newest national mediocre, that is just 0.08percent. Store this page to remain up-to-date with the newest casino no-deposit bonus codes 2025. Then i redeem them and you may test them over to ensure they are working accurately, then screen them on this page. You are going to usually discover no deposit free spins because the an energetic user otherwise as an element of a pleasant offer, and 120 totally free spins the real deal money. Watch out for “Games of your Week” promos, that can prize your bonus spins for the a specific online game from the plenty of websites we recommend.

The brand new FDIC – to own banking companies – as well as the NCUA – to own borrowing unions – guarantee member loan providers up to 250,100000 for each and every depositor. The earnings to own a premier-yield checking account trust the brand new account’s APY and the period of time you’lso are offered. During the 4.35percent APY, fifty,one hundred thousand do secure regarding the dos,176 in one single seasons, just in case the speed doesn’t transform and you can desire is compounded everyday.

Overdraft percentage–based accounts was commonplace, and you can financial team had been unwilling to speak about smaller choices so you can possible people even though they certainly were offered. Early access to lead deposit fund is founded on the fresh time in which i receive observe of upcoming payment on the Government Reserve, which is typically up to two days through to the scheduled payment go out, but could will vary. FinanceBuzz doesn’t come with all economic otherwise credit now offers that might be around in order to users nor will we tend to be the companies or the available items. Suggestions, as well as cost and you will fees, is exact at the time of the newest posting time possesses not already been given otherwise supported by the advertiser. J.P. Morgan Individual Buyer features a very high minimal balance dependence on 10 million.