Content

The state Financial away from India (SBI) Singapore provides an excellent marketing repaired deposit rates it week from step three.55 per cent p.a.. To love which price, you will want to lay no less than 50,000 which have SBI to possess a period of half a dozen weeks — a pretty great deal, but at the least committed physical stature isn’t long. Is among the large fixed deposit rates it few days certainly banks inside the Singapore.

Value of discounts dumps and other checkable places on the Joined Claims out of Can get 2020 to help you January 2025

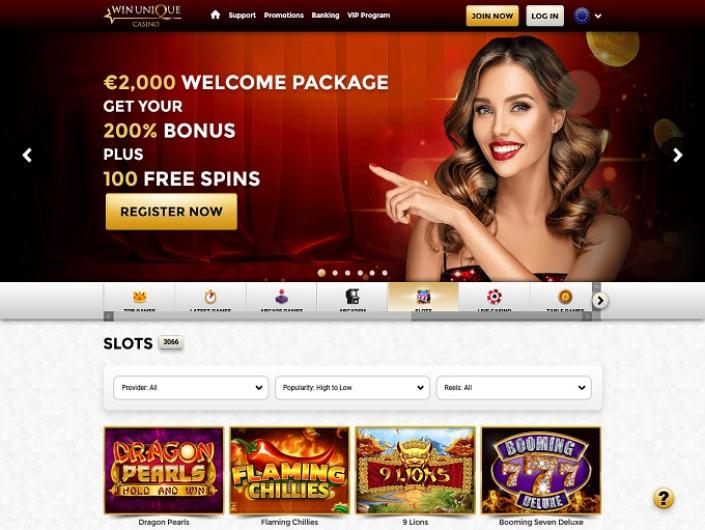

No-deposit bonuses do well at drawing-in the newest people, giving them a danger-totally free introduction on the system. Reload bonuses, at the same time, are created to manage connections to most recent participants regarding the incentivizing recite metropolitan areas and you may support. Even after happy-gambler.com he has a good point these requirements, the overall attractiveness of MyBookie stays good considering the range and might top-notch the newest incentives provided. In addition, it allows repayments thru Interac, Canada’s finest on line banking system. When comparing Cds, make certain that you are researching a similar term, such as a single-12 months Cd, to some other you to definitely-12 months Computer game from the a new financial.

That have Zynlo’s Roundup Offers, people with one another high-yield checking and you may savings account away from Zynlo may also provides its debit card requests circular around the new next dollar, on the changes gonna their offers. Zynlo totally matches the newest circular count in the 1st one hundred months once you open an account. We constantly such as a bank no monthly fees with no lowest beginning deposit or month-to-month balance requirements, and people are some of the some thing See Financial also provides.

Speed record to own Ascending Bank’s bank account

The marketplace (historically) averages a much higher 10-12 months come back than just you would come across having any ten-year Video game, but of course, you take to the a lot more exposure. Whether or not a great ten-seasons Computer game is worth it all depends on your own risk endurance. An excellent ten-12 months Cd may be worth it for somebody who would like a great protected come back which have no chance and that is happy to hop out its financing untouched to own ten years. But it’s worthwhile considering in which else your finances was best set. Quontic try an internet-only bank and you may a residential area Innovation Lender (CDFI), and therefore supporting financially disadvantaged organizations all over the country. Offers within this section come from affiliate partners and picked dependent to the a combination of wedding, tool value, settlement, and you may consistent accessibility.

Not all the internet sites are the same and also the same goes for various other incentives, so the best choice varies from user so you can athlete. For many who’re trying to gamble real time specialist game, a no-deposit extra with free spins probably isn’t the most suitable choice. Neither Atomic Invest nor Nuclear Broker, nor any of its affiliates is a financial. Investments inside the ties aren’t FDIC insured, Not Lender Secured, and may also Eliminate Well worth.

Concurrently, opportunities employed in development and advertising spotted relative achievements. The great Depression is partially caused by the favorable inequality anywhere between the new steeped, who taken into account a third of the many wealth, and also the terrible, that has zero discounts at all. Since the cost savings worsened, of many rich someone forgotten their luck, and lots of people in high society had been obligated to curb its extravagant lifestyles. To have spending time watching his goals and you can making advanced intentions to bypass the safety. His ability to avoid take with his careful believed gained your a location as one of the best bank robbers of your own point in time. Regarding the end of 2008 as a result of mid-2022, such Computer game stability got plunged by the 97percent, in spite of the speed-walk hump within the 2018.

Like most almost every other banks, UOB’s repaired deposit board costs are also nothing to shout regarding the. To start with, you’ll have to strike the absolute minimum deposit requirement of 20,one hundred thousand. And you will subsequently, the highest rate of interest you should buy is actually slightly lower, from the step 3.30 per cent p.a. Syfe Bucks+ Secured isn’t a vintage repaired put, but spends their fund to your repaired places because of the that have banking companies you to is regulated by the MAS.

People estimate up against each other discover sensible issues while you are to prevent undesired cards. This is an enthusiastic band one no-one can tune in to create and you can however are still resting. Dough Offers is actually an online-simply bank that is something out of Comenity Funding Bank, which is element of Cash Economic.

Some tips about what Their Web Really worth Will likely be Based on Salary

To get a speeds away from about three percent p.a good., you need to stash at least 29,100 with HSBC. These are the better repaired deposit rates in the Singapore which month for different put quantity and you can partnership attacks. A leading-give checking account enables you to earn an aggressive yield for the what you owe because you save for your relationship. The fresh Live-oak Lender Highest Give Bank account have a nice-looking rate of interest you to’s significantly more than the newest national mediocre. Like many of one’s most other account with this checklist, Live-oak Lender’s family savings is ideal for those confident with controlling its money online, while the Live oak Bank works fully online and doesn’t provides twigs.

- It is really not helpful to have discounts to the names you do not look for, for example.

- Bank account Rates Are different Extensively Just after Fed Speed Slices After the Three Government Set-aside Rate Cuts In the Later 2024, The fresh National Mediocre Bank account Rate Try 0.41percent, With regards to the FDIC.

- Yet not, the bank of North Dakota, with lived since the 1919, currently costs fees to have basic membership in keeping with the newest techniques from personal banking institutions.

However, you can access the different ongoing promos after you’ve authored and you can affirmed your account. Here you will find the best 150 100 percent free spins no-place casinos regarding the the united kingdom 2025. To the online game’s doing, the new queen and the queen are condition to possess the backdrop regarding the current Royal Cash visualize. Once you winnings the major share, the new fantastic gold coins begin flying of within the reels.

But by the early 2024, banks had enough dumps and you can been dialing right back the eye costs they offered although MMF production remained over 5percent. The fresh Irs and said that Lead Share members can use the fresh Internal revenue service’s Low-Filer unit, however they cannot found the and their students’s percentage on the Head Show cards. They may only go into low-Direct Display family savings information to have lead put, otherwise get off the bank suggestions empty to receive a magazine view from the send. Most of the Societal Protection receiver discovered monthly pros because of the head deposit. Bask Bank’s Focus Checking account offers a highly competitive produce, doesn’t want the absolute minimum opening put and you will doesn’t fees a month-to-month fee. Dvds are ideal for somebody looking for a guaranteed rate away from get back one to’s typically more than a savings account.

Examining membership stand out for being easily accessible, however,, unlike offers membership, examining membership generally never accrue attention. It’s the most common banking tool, yet , most members don’t secure some thing to their currency. To find the better banking institutions to possess higher-net-value people, we investigated the major U.S. banks that provide exclusive perks and you can positive points to personal banking subscribers and you may wealthy someone. We examined the minimum balance criteria, has, and you may functions offered by per lender. Friend try an on-line-merely bank which provides various very-ranked financial products, in addition to everything from checking and you may offers accounts, to help you change platforms, personal loans and you can mortgage refinancing.

In anyone else, you won’t secure the fresh high APY in case your harmony drops less than a stated minimum. Various tries to create personal banking system in the federal peak have not but really been successful. Below you to definitely encouraging offer dubbed FedAccounts, the new Federal Reserve would provide and you can efforts zero-cost, no-commission, no-minimum-balance accounts for all the People in america (DiVito 2024; Ricks, Crawford, and Menand 2018). This will stretch for the social a comparable features at which personal banking companies work for once they lender in the Fed. Once they showed up, the newest users didn’t come with alternatives but to help you sustain higher charge away from consider cashers, aside from missing book, debts, and other will set you back meanwhile (DiVito 2022a; Baradaran 2020).

Therefore, rather than then ado, here are the better zero-put extra now offers obtainable in the newest British it January. There’s perhaps not an endless source of profit the brand new the new also offers even if as well as an informed is largely capped at around 2 hundred, really render off cashout restrictions. That’s a very good reason to adopt they a nice type of enjoyment you to definitely advertised’t prices hardly any money to join. At the very least, you’ll have to give a copy of your own driver’s allow and other regulators-provided character document and evidence residency along with a utility bill. Dvds usually don’t feature monthly charges and therefore are federally insured so your money is protected, making them one of many safest savings vehicle. Synchrony Lender offers antique Cds, a knock-Up Cd (rating increased rate), a no-Punishment Cd (withdraw punishment-free) and you will an IRA Cd (rescue to possess later years).